Financial Articles

Educational content to improve your financial knowledge and decision-making skills

Our articles cover key financial topics with practical insights and actionable advice. Each article is based on current financial best practices and research to help you make informed decisions about your money.

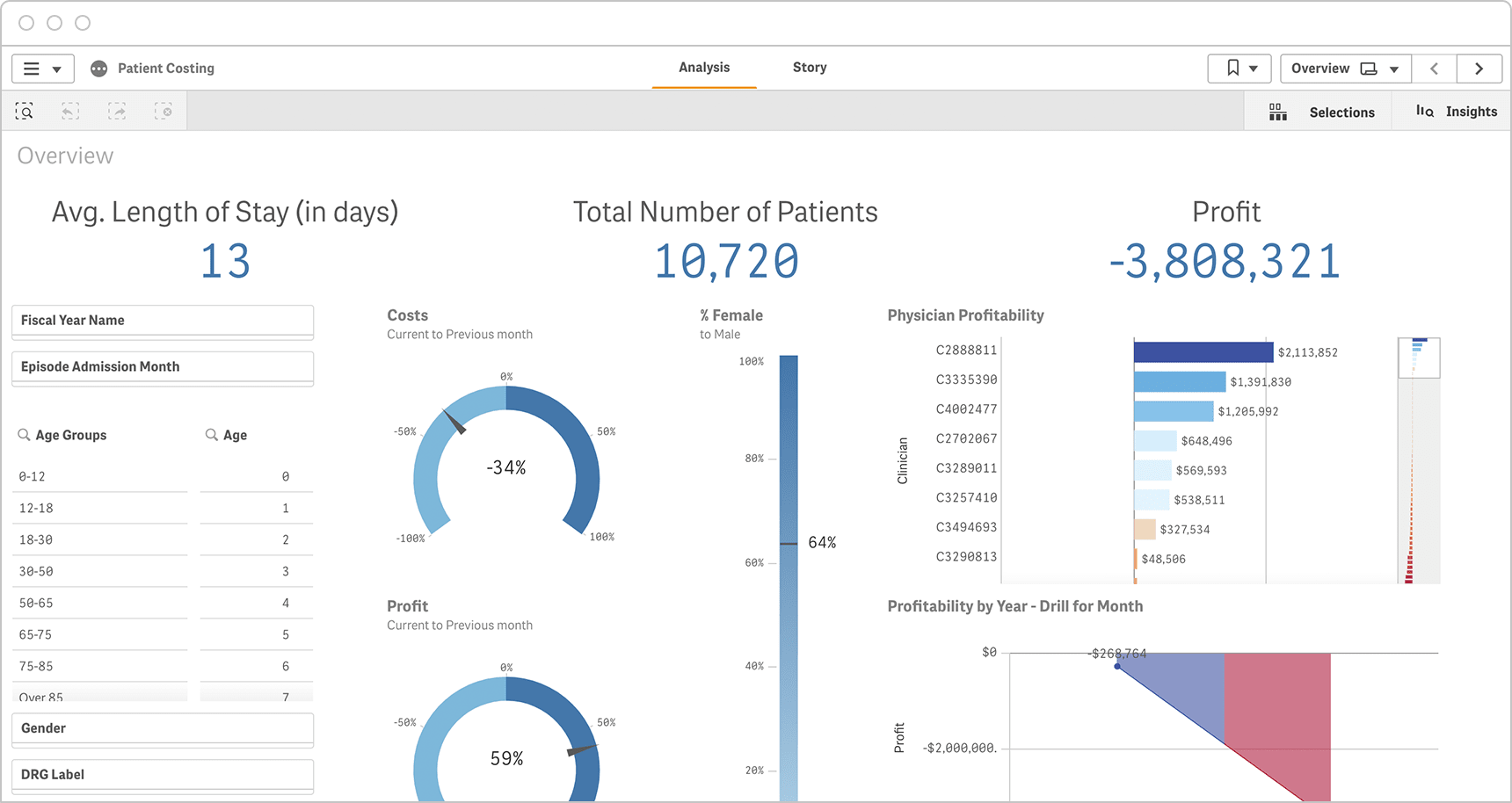

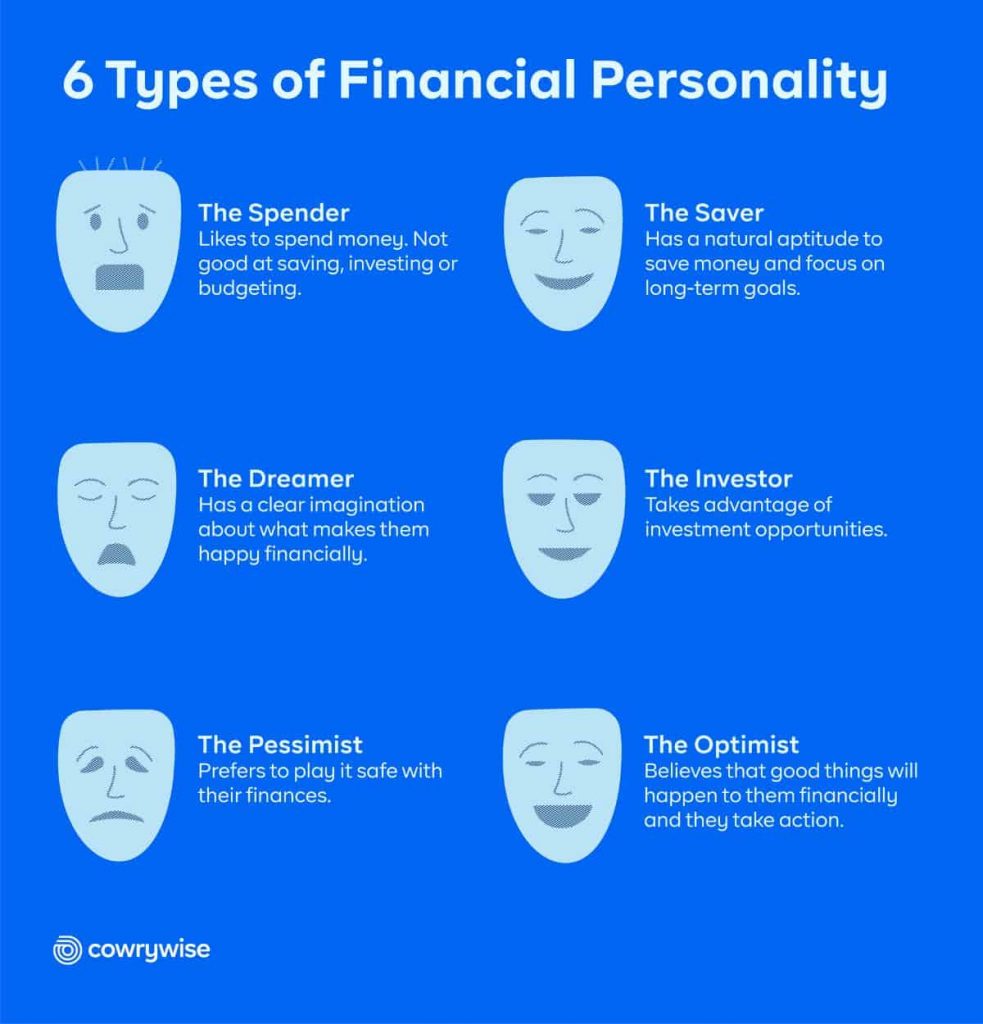

Understanding Money Personalities

Learn how different money personalities approach financial decisions and how to leverage your natural tendencies. This article explores the psychological aspects of financial behavior and provides strategies for working with your unique money personality.

Read Article

Building an Emergency Fund

Discover strategies for creating and maintaining an emergency fund that provides financial security. Learn how to determine the right size for your emergency fund, where to keep it, and how to build it efficiently even on a tight budget.

Read Article

Smart Debt Management

Learn effective strategies for managing and reducing debt while building a strong financial foundation. This article covers debt prioritization methods, consolidation options, negotiation techniques, and how to avoid common debt traps.

Read Article

Investment Basics

An introduction to investment concepts and strategies for beginners looking to grow their wealth. Learn about different investment vehicles, risk management, diversification principles, and how to create an investment strategy aligned with your goals.

Read ArticleBudgeting Techniques

Explore different budgeting methods and find the approach that works best for your lifestyle. This article covers zero-based budgeting, 50/30/20 rule, envelope system, and other techniques to help you manage your money effectively.

Read Article

Financial Protection

Understanding insurance, estate planning, and other ways to protect your financial future. Learn how to assess your protection needs, choose appropriate insurance coverage, and create essential estate planning documents to safeguard your finances.

Read Article